No one has ever explained how a venture capitalist plays an active role in creating world-changing companies. The venture capitalist often hires the senior management, helps develop the business model, introduces the company to its largest customers, and provides governance. It is a role akin to being an entrepreneur, not just an investor. This book tells stories of the good, the bad, and the ugly of creating companies, and explains how the VC industry created 80 percent of the American economy. The industry now faces severely damaging legislation. Venture capital is different from leverage buyouts and hedge funds and needs to be regulated in an entirely different way.

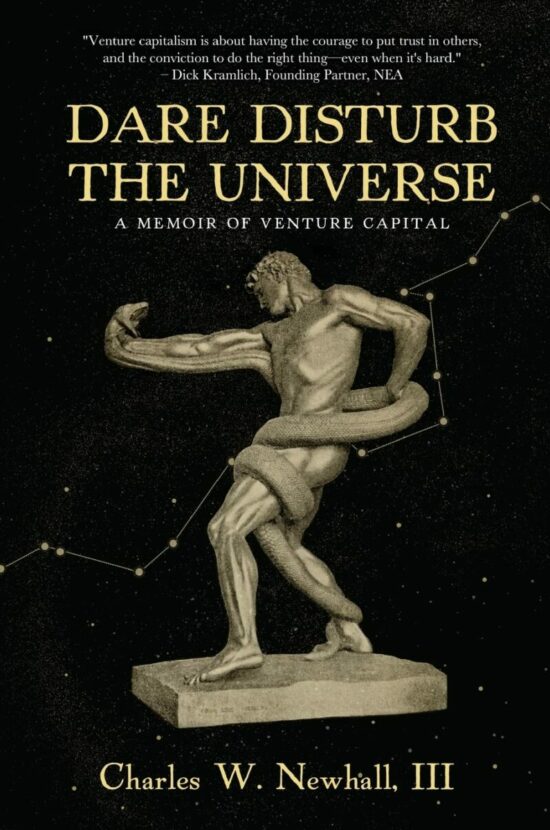

Dare Disturb The Universe: A Memoir of Venture Capital